Senior Spotlight: Top Retirement Systems (None Are In The US)

A just-released ranking reveals which top 10 countries offer the best benefits for older adults.

When it comes to world ranking of retirement systems, it would appear the US has much to learn. AARP has shared the results of the 2023 Mercer CFA Institute Global Pension Index, and the United States ranks #22 among 47 countries rated. Wondering exactly what is being measured? According to Margaret Franklin, President and CEO of the CFA Institute, “Those that rise to the top of the index have demonstrated that they have a robust and established retirement income system that has been designed to deliver good benefits for pension plan participants over the long term.”

Researchers of the cited study measured the retirement systems of 47 countries by grouping key, measurable indicators into 3 categories:

ADEQUACY. How much do retirees receive relative to working wages in the country?

SUSTAINABILITY. Can the system weather demographic change and financial challenges?

INTEGRITY. Is the system, particularly its private providers, well-regulated and trustworthy?

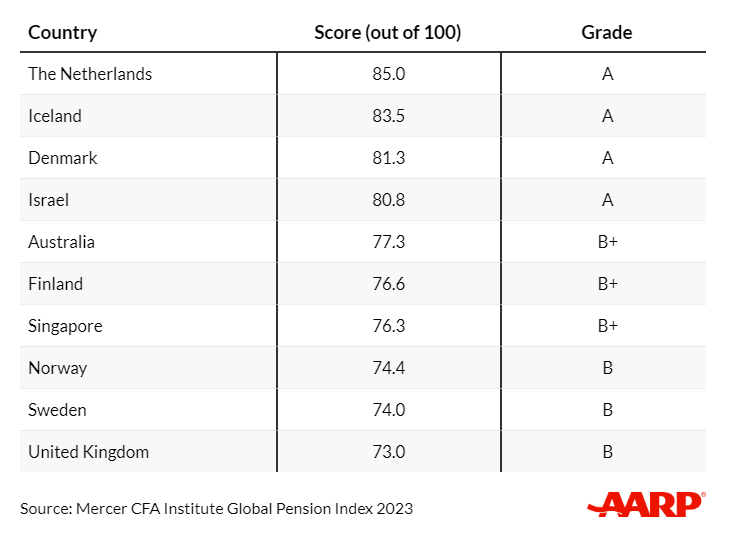

The top 10 countries are listed below. The Netherlands retirement system is considered the world’s best. The United States ranks in the middle of the pack (sharing the same score as Colombia, Croatia, France, Hong Kong, Kazakhstan, Spain and the United Arab Emirates).

While the ‘pitfalls’ or obstacles within the US retirement system are complex and multi-faceted, AARP summarizes a few specific areas of improvement. The index report states that the US retirement system “…has some good features but also has major risks and/or shortcomings that raise questions about its effectiveness and long-term viability.” A lack of guaranteed income from workplace pensions (which are few and far between!), inaccessible high return investment options, under-planning from most individuals but especially self-employed & gig economy workers, plus minimal employee paycheck contributions and workplace matching are just a few areas of growth potential.

To read more about what works and doesn’t work in retirement systems around the world, we encourage you to read ‘10 Countries with the Top Retirement Systems’ from AARP.

Note that the US not scoring high is not intended to scare you; it does however emphasize the importance of personal proactivity, planning and accountability. It is almost never too early to start thinking about retirement and never too late to make adjustments that optimize your quality of life and financial situation.

Warmest wishes,

Bobbi Decker

DRE#00607999

Broker Associate

650.346.5352 cell

650.577.3127 efax

www.bobbidecker.com

NAR Instructor….“Designations Create Distinctions”

CIPS, SRS, ABR, CRS, SRES, GRI, CLHMS, REI, AHWD, RSPS, MSLG

Bobbi Decker & Associates fully supports the principles of the Fair Housing Act and the Equal Opportunity Act. For more information, please visit: http://portal.hud.gov/